To our shareholders and

other stakeholders

At this time last year, we wrote to you about the many changes under way in our markets and about the new leadership team at the helm of Thomson Reuters. 2012 was a watershed year for our company as we worked to turn change into opportunity and laid the groundwork for growth by developing better products, improving customer service, simplifying systems and processes, and taking out costs — in short, by executing better.

At Thomson Reuters, we succeed when we combine world-class, expert-enriched content with technology to serve professionals in information-intensive industries. We inform and connect the professional communities at the very heart of the knowledge economy. “Big Data” is not big news to us — we have years of experience applying technology to complex data. With the rapid pace of change in our industries, we seek to be innovative and agile, evolving our products, services and company to meet our customers’ constantly evolving needs.

Looking Back on a Watershed Year

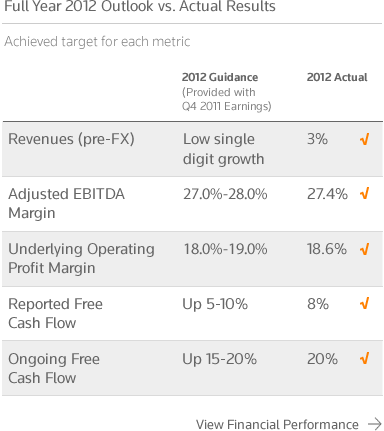

Our 2012 performance demonstrated the resilience of our business. Despite a challenging economic environment and several operational issues that needed repair, we achieved our financial targets for revenues, profit and free cash flow. Across the company, our businesses recorded improved customer satisfaction ratings and improving retention rates for the year — two performance indicators essential for our long-term success. Our professional businesses once again delivered solid results, with revenues collectively up 6% for the year.* * Revenue growth rates are before currency, as we believe this provides the best basis to measure the underlying performance of the business. Importantly, it was the year that we turned the tide in our financial business, making foundational progress that we expect will pay off in the years to come.

We rebuilt the growth engine in our financial business by improving product quality and customer service, and by beginning the transformation from a product-centric company with multiple standalone offerings to an integrated platform business whose solutions integrate, complement and build on each other. Organizationally, we made great strides in establishing quantifiable performance measures and clear lines of accountability. Operationally, we aligned sales and support operations, consolidated business sectors, simplified commercial policies and moved 42 separate billing systems onto one, all while rationalizing the product lineup. Net sales, a key indicator of future financial performance, showed improving momentum during the year.

Strategy is all about making choices — where to place bets but also where not to play. In 2012, we sold our healthcare business and four smaller businesses because they were not core to our growth strategy. We completed a number of acquisitions to support our growth businesses. Key acquisitions included MarkMonitor, a leader in online brand protection, and FXall, the leading independent global provider of electronic foreign exchange trading solutions to corporations and asset managers. These are fast-growing businesses that further strengthen our position in core markets.

We continued to exploit our distinctive strengths, especially at the intersection of regulation and finance. This remains one of our fastest growing areas, as evidenced by the 17% organic revenue growth turned in by our Governance, Risk & Compliance unit last year.

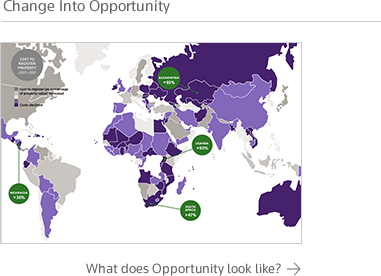

We accelerated development of our business in fast-growing geographies. Just getting better in our core markets will not be sufficient if the majority of global growth happens elsewhere. Our Global Growth & Operations organization, which focuses exclusively on these geographies, grew revenues 19% in 2012 and is perfectly situated to build on that foundation.

Reuters News won nearly 100 top journalism prizes around the world and made significant progress in aligning coverage plans with the commercial strategies of our businesses, adding more insight to our reporting, using data in smarter ways and having our journalists moderate dynamic virtual communities of customers and influencers.

Moving Forward from a Stronger Position

We entered 2013 with far more confidence and a much stronger foundation. We are focused squarely on revenue growth and profitability, with a particular emphasis on stimulating that growth organically. We will support those efforts with targeted acquisitions such as Practical Law Company (PLC), a leading provider of legal know-how, current awareness and workflow tools that we acquired earlier this year. Across the company, we will continue to focus our investments on those areas of the business with the greatest opportunities for growth.

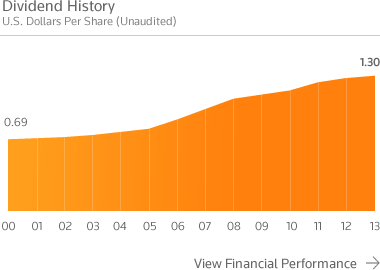

We will continue to simplify our business and to improve levels of customer service. We also remain committed to a prudent capital strategy that effectively balances re-investment in the business with returns to shareholders. Over the last five years, we have returned more than $5 billion in capital to shareholders through a combination of dividends and share buybacks. This February, based on our strong capital position and confidence in the cash-generating capacity of our company, we announced the 20th consecutive annual increase in our dividend to shareholders.

Doing Our Part

At Thomson Reuters, we feel a strong obligation to use our skills, assets and global reach to make a difference in the world. We carry out this mission both through a series of corporate responsibility programs and through our support of the Thomson Reuters Foundation.

Corporate Responsibility (CR) is an integral part of the way we do business. Our CR policy describes how we manage our impact in four areas: the community (the places and societies where we operate), our workplace (employees), the environment and the marketplace (customers, suppliers and investors). By articulating focus areas, we are able to define our responses to global standards and charters in ways that are meaningful to our business.

In 2012, the reorganization of our company resulted in a more efficient global structure, enabling us to better align our CR programs to core business activities and to increase our positive impact. Our CR approach is connecting people across our organization to help improve employee health, safety and wellbeing; boost motivation levels and employee engagement; and support the development of sustainable products and services.

Thomson Reuters Foundation

Trust.org

Visit Trust.org

In addition, we are proud to support the Thomson Reuters Foundation, a global charity which runs unique programs around the world that trigger change and empower people: from free legal assistance to media development and in-depth coverage of the less-reported news stories such as corruption, women’s rights and humanitarian issues.

Saying Thanks

As always, our sincere thanks go to our customers, who are the heart of everything we do, and to our shareholders for their loyalty and support. As we described in last year’s letter, “Customer First” was the overarching guideline for reorganizing our company and it remains our mantra as we continue to improve customer service and user experience, develop innovative new products and simplify our infrastructure to benefit the professionals, corporations and governments we serve.

We also want to give special thanks to our 60,000 employees in more than 100 countries. 2012 was a year of significant internal change; many employees found themselves reporting to new managers. In some of our businesses, it was a year of marching steadily forward against strong headwinds in the external environment. We want to thank our colleagues for staying focused on their customers and on driving the business — for viewing change not as a distraction but an opportunity.

Sincerely,