- Overview

- Financial Results

- Non-IFRS Basis Performance Measures

- Cash Flow

- Revenue Profile

- Business Segment Revenue

- Business Segment Adjusted EBITDA

- Business Segment Underlying Operating Profit

- Business Segment Adjusted EBITDA and Adjusted EBITDA less Capital Expenditures

- Consolidated Income Statement

- Consolidated Statement of Financial Position

- Consolidated Statement of Cash Flow

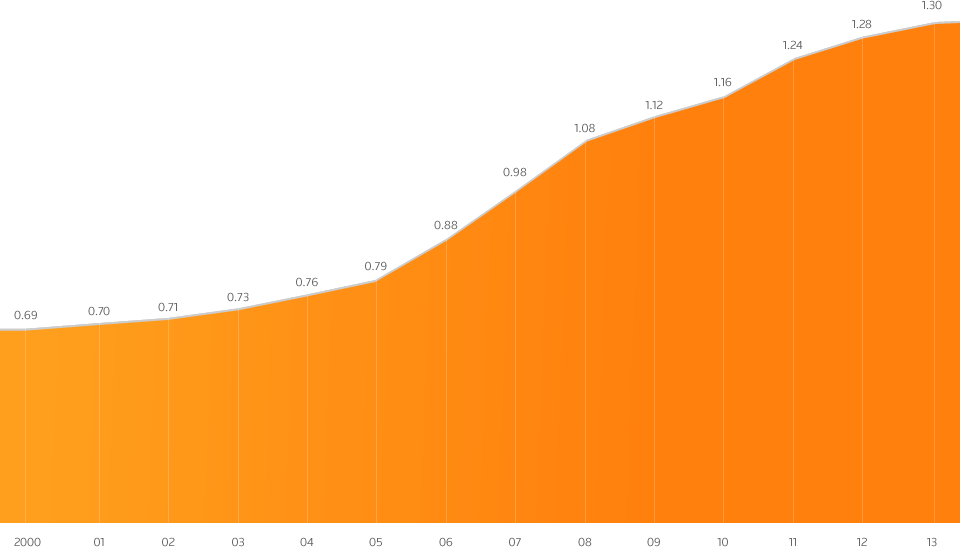

- Dividend History

- Reconciliations

- Reconciliation of Operating Profit (Loss) to Underlying Operating Profit and Adjusted EBITDA

- Reconciliation of Earnings (Loss) from Continuing Operations to Adjusted EBITDA

- Reconciliation of Underlying Operating Profit to Adjusted EBITDA by Business Segment

- Reconciliation of Earnings (Loss) Attributable to Common Shareholders to Adjusted Earnings

- Reconciliation of Net Cash Provided by Operating Activities to Free Cash Flow from Ongoing Businesses

-

Dividend History

U.S. Dollars Per Share (Unaudited)

- This document includes summary financial information and should not be considered a substitute for our full financial statements, including footnotes, management/auditors’ reports, and related management’s discussion and analysis (MD&A). You can access our 2012 audited financial statements, MD&A and other annual disclosures in the “Investor Relations” section of our website, www.thomsonreuters.com, as well as in our filings with the Canadian securities regulatory authorities and the U.S. Securities and Exchange Commission.

- We also use certain non-IFRS financial measures. These measures include revenues from ongoing businesses, adjusted EBITDA and the related margin, adjusted EBITDA less capital expenditures, underlying operating profit and the related margin, free cash flow, free cash flow from ongoing businesses and adjusted EPS. Non-IFRS financial measures are defined and reconciled to the most directly comparable IFRS measures in this annual report and our 2012 annual MD&A. We use these non-IFRS financial measures as supplemental indicators of our operating performance and financial position. These measures do not have any standardized meaning prescribed by IFRS and therefore are unlikely to be comparable to the calculation of similar measures used by other companies, and should not be viewed as alternatives to measures of financial performance calculated in accordance with IFRS.

Close